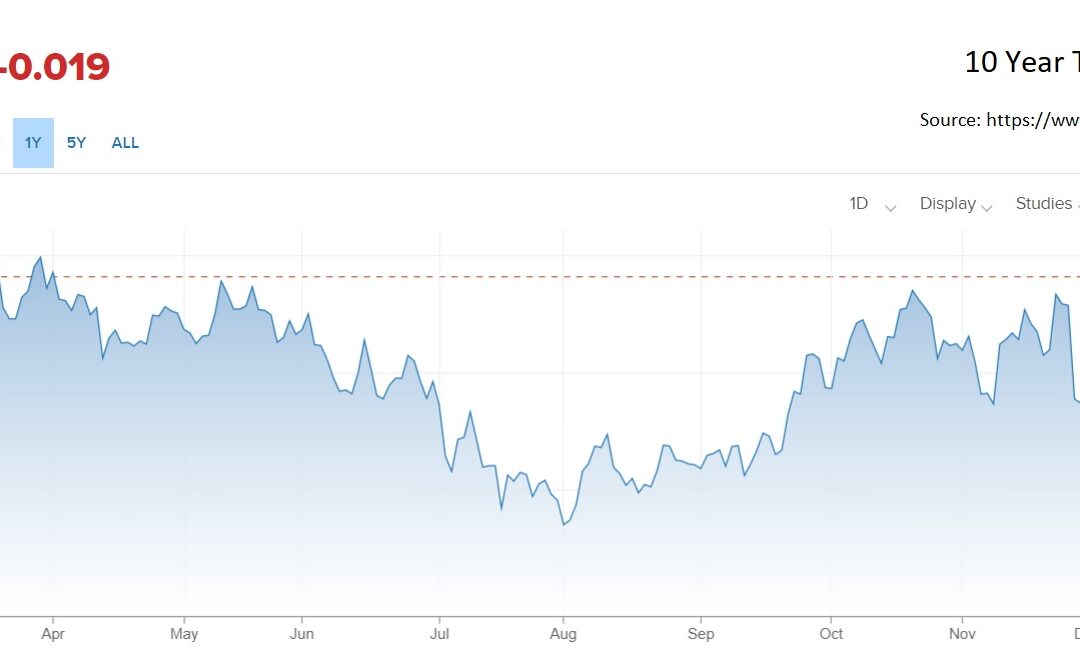

Will interest rates rise in 2022?

The easy answer is that interest rates have already risen. Rates have already risen in the longer-term maturities, such as 10 year Treasuries, going from 1.2% in August to 1.72% this week. There are almost as many people estimating (or guessing) where interest rates will go, as there are mathematical models to create these forecasts.

Allow us to position the question – of where interest rates will go – under the observation that markets confound forecasters constantly. Governments and their central banks restraining rate changes by buying and selling financial instruments also add to the complexity of making a forecast. Yes, interest rates are a rigged market now.

Managing complexity is the mark of a great forecaster. If you want to see some of the ways to judge it, here’s a great article: https://docs.oracle.com/cd/E16582_01/doc.91/e15111/und_forecast_levels_methods.htm#EOAFM00177

Three main assumptions

So instead of the “pick a forecast that you agree with” tendency, let’s discuss the assumptions behind the forecasts instead.

Assumption #1: can the Federal Reserve stop managing interest rates by buying and holding bonds (the so-called “financial repression”) which has reduced the tendency of rates to rise?

We argue they cannot, for both political and economic reasons.

Assumption #2: Can the actions of other central banks (China, EU, UK, Japan etc.) which copied the US remove their rate management?

Again, we would answer no, as Japan has been unable to get out of the low-rate environment for decades now. Overseas central banks have already changed their levels of “repression” earlier than the US Fed has done. Companies can borrow anywhere. We are still an inexpensive country to borrow from or in. So far, this hasn’t crowded out any US borrowers here.

Assumption #3: Can the Federal Reserve raise interest rates, when they have often communicated that they want longer-term rates above short-term ones?

They have preferred to keep about 1% between short-term rates and long; however, they also must avoid losses on positions and be aware of their own funding mechanisms. Recent Fed action has used words more than deeds to move markets.

The US is in a better position if it raises interest rates slower than other countries. A slower withdrawal of stimulus keeps a highly interest rate sensitive economy – such as the US – stronger for longer. It also permits a more careful examination of any damage that rising rates can and do cause, with a quick response if problems occur. It is reasonable to expect that Fed Funds will rise to yield 1.5% by the end of 2022 from 0.07% now. But at that level, the economy will already be slowing, with a likely recession by late 2023. Slowing growth allows the Fed to worry less, as inflationary pressures ease.

Supply chain resolutions, such as onshoring of production and distribution of goods from abroad have also raised prices (but not inflation). The supply chain constrictions caught the unaware off-balance and forced them to pay up for inadequate inventory. This price shock is not permanent and should disappear over the next 18 months. Again, lower inflationary factors are starting to appear already. This can be seen in rising delivery speeds, falling transportation backlogs, falling ocean container prices, and other data.

COVID worker sickouts, inventories increasing, and China slowing from regulatory and legal pressures all will slow the economy early this year, pushing out the ability of the Federal Reserve to increase rates four times in 2022. We do not expect the Fed to raise interest rates four times, as both market prices and consensus surveys show now. Interest rates can be like a one-year-old: lots of movement, a tendency to stay in the same general place for a while, and the ability to create panic in the inexperienced parent.

What to do with these observations?

We have mentioned that we expect to see higher unplanned inventories this quarter; they are showing up already. Inventory builds will come from the late 2021-Q4 over-ordering of inventories, along with higher than 2021-Q1 holiday product returns. There will be companies which have placed themselves in a precarious position of having slowing accounts receivable collections and increasing payables demands. This increasingly negative working capital problem will force companies to defer or sell inventory.

Our Fall advice still holds

We suggest companies increase available credit lines and get ready to acquire the discounted inventory we anticipate. If this is handled well, it could easily add 100-200 basis points to the company’s gross margins by December 2022. That could make for a nice bonus increase for the CEO, COO & CFO.

Call us ASAP for timely inventory funding.