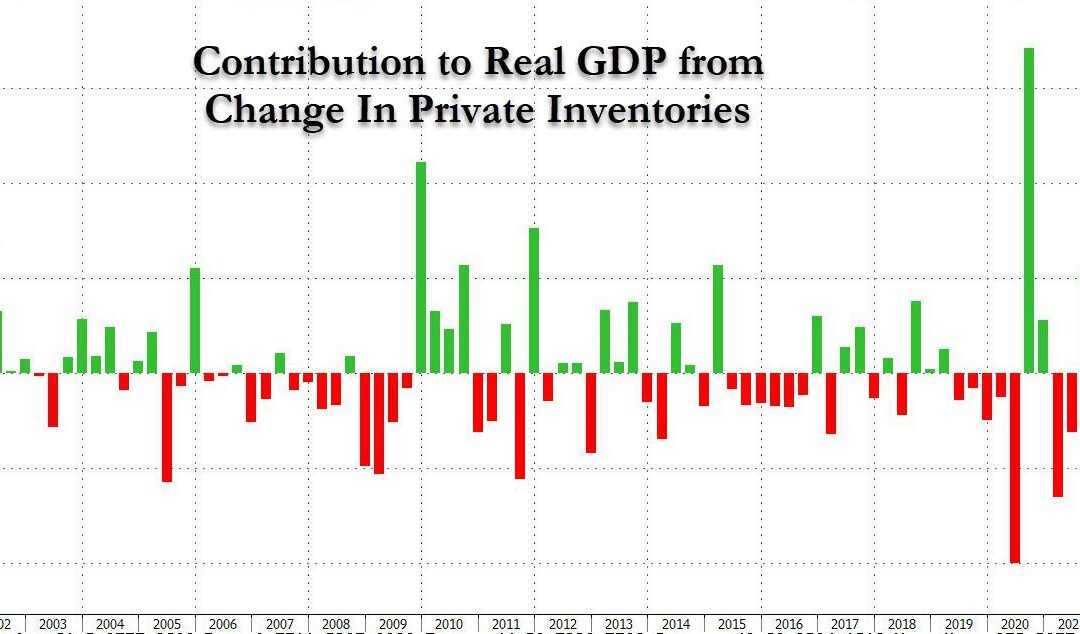

Don’t look now, but you just got “st*cked”. 2022 is the year “When Just-In-Time” changed to “Just-In-Case” (as our guest Andy Tomat said this week).

We have previously warned about the growing inventory bubble. Companies double and triple ordered parts and supplies.

GDP Report

Today’s GDP report confirms our analysis. Inventories at large companies jumped enormously in the last quarter.

Inventories contribution to GDP growth, via ZeroHedge

Yesterday, Chairman Powell of the Federal Reserve made it clear the Fed will reduce financial stimulus in March. This follows the State and Federal stimulus reductions in the fourth quarter of last year. Orders in China have already slowed down. Many low-cost business inputs that come from there. Already, certain goods have stopped increasing in price. If you want an example, look at luxury goods sales there. Tesla is now exporting cars that they had planned to sell in China.

We have not seen many banks cut back on inventory loans or general lines of credit yet. We do expect it soon. So far, their customer’s financials from last year look excellent. It won’t be until April, that you will see the slowdown in reported earnings. You will see it in the monthly economic data before April.

We know who is lending and where

Getting a new loan from a bank that is not familiar with your business model, can take 30-60 days. If they begin to reduce credit allocated to certain areas, it can take even longer. This is one reason clients hire us, as we work with many banks at the same time to get a loan funded. The borrower is not dependent on applying, at one, waiting for an answer, and when declined, having to start over again elsewhere. That’s not an advertisement. It’s a fact. We know who is lending and where. That’s what we do.

Seasoned CFO’s will tell you to borrow when you don’t need it. We agree. Yet this time, businesses need to borrow because they will need it. Talk to us, talk to your bank, or talk to someone who can help you. Don’t be one of those businesses that are over-stocked, with poor available liquidity. Be aware the percentage of banks eager to lend has stopped increasing and is now falling. The closer you get to tax season, the harder it will be for your CPA to make time to help you compile financials.

You need to do this now. It will be the difference between a good year and not poor one.

Diamant Carré Newsletter

P.S. – if you find these comments helpful, sign up here to get our notes immediately by email. Additionally, you’ll get our upcoming “Square Deals” webinar schedule, where we interview interesting business leaders.